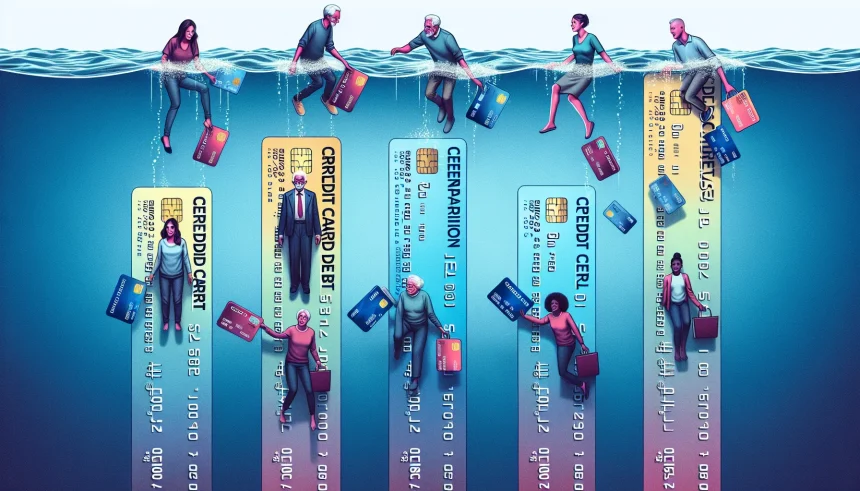

Credit card debt remains a significant financial burden for Americans, with notable differences in how much each generation carries. Recent data shows distinct patterns in credit card balances from the youngest adults of Generation Z to the eldest members of the Silent Generation.

The distribution of credit card debt across age groups reveals important insights about spending habits, financial priorities, and economic challenges facing different generations. While some groups manage to keep their balances relatively low, others struggle with higher levels of revolving debt.

Generational Debt Patterns

Generation Z, the youngest adult consumers born after 1997, currently carries the lowest average credit card debt among all generations. This may reflect their shorter credit histories, lower credit limits, and potentially more cautious approach to borrowing after witnessing the financial challenges faced by older generations.

Millennials, now in their late 20s to early 40s, show a significant jump in average credit card balances compared to their Gen Z counterparts. Many millennials accumulated debt during their early career years while facing challenges like student loans, rising housing costs, and the aftermath of the 2008 financial crisis.

Generation X consumers typically carry the highest credit card balances of any generation. Now in their 40s and 50s, Gen X often juggles multiple financial responsibilities including mortgages, child-rearing expenses, and potentially caring for aging parents, creating a perfect storm for credit reliance.

Baby Boomers show a gradual reduction in credit card debt compared to Gen X, though many still maintain substantial balances. Some Boomers carry debt into retirement, creating financial stress during fixed-income years.

The Silent Generation, those in their late 70s and beyond, maintains the lowest average credit card balances among adult generations, reflecting both their spending habits formed during more frugal eras and their stage of life with fewer major expenses.

Factors Influencing Generational Debt Loads

Several key factors contribute to these generational differences in credit card debt:

- Income levels: Peak earning years typically occur during middle age, allowing Gen X and Boomers greater borrowing capacity

- Life stage expenses: Major costs like home purchases, raising children, and education expenses hit different generations at different times

- Economic conditions: Each generation faced unique economic environments during their formative financial years

Financial experts note that credit access also plays a significant role. “Older generations typically have longer credit histories and higher credit scores, giving them access to more credit,” explains one financial analyst. “This can lead to higher potential debt loads, even if they’re using a smaller percentage of their available credit.”

Financial Implications

The consequences of carrying credit card debt vary by generation. For younger consumers, high-interest debt can delay important milestones like homeownership or retirement saving. For older Americans, especially those approaching or in retirement, credit card debt can threaten financial security when income becomes fixed.

Interest rates compound these challenges. With credit card rates reaching historic highs in recent years, consumers carrying balances face increasingly expensive debt servicing costs, regardless of age.

“The generational differences in credit card debt tell an important story about financial health across America,” notes one consumer finance researcher. “It’s not just about how much people owe, but how that debt impacts their ability to meet other financial goals.”

Financial literacy efforts increasingly target specific generational needs, with younger consumers receiving guidance on building credit responsibly, while older Americans focus on debt reduction strategies before retirement.

As economic conditions continue to evolve, these generational patterns may shift. Rising interest rates could prompt more consumers to prioritize debt reduction, while economic uncertainty might drive increased reliance on credit across all age groups.

Understanding these generational differences provides valuable context for consumers to evaluate their own credit situations and develop appropriate strategies for managing debt at any age.