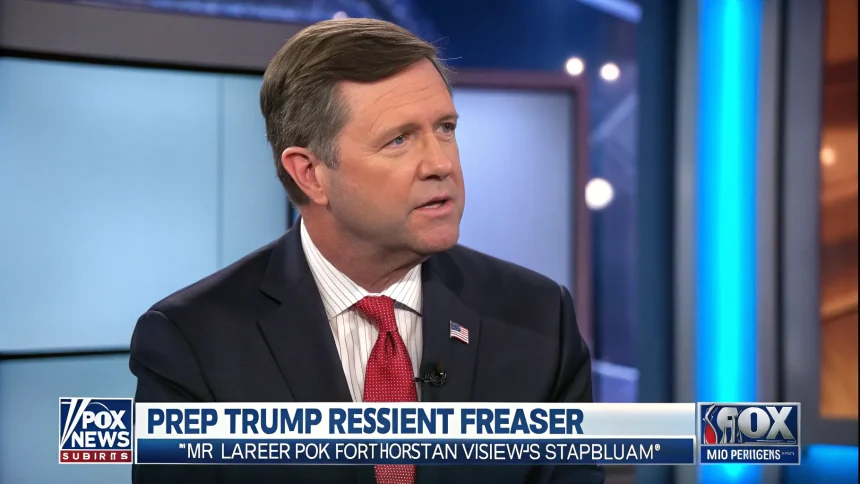

Republican Representative Mike Lawler of New York has voiced opposition to former President Donald Trump’s tax legislation during an appearance on Fox Business Network’s “Varney & Co.” program.

The congressman’s stance highlights growing divisions within the Republican Party over tax policy as the GOP continues to navigate its post-Trump identity while still maintaining connections to the former president’s legislative agenda.

Lawler, who represents New York’s 17th congressional district, used the television appearance to explain his position against specific tax provisions championed by Trump during his administration. While the exact details of his objections weren’t specified in the program description, his appearance signals continued debate over the economic legacy of the Trump presidency.

Republican Tax Policy Divisions

Lawler’s opposition comes at a time when Republicans are reassessing their approach to tax policy. The Tax Cuts and Jobs Act of 2017, Trump’s signature legislative achievement, included significant corporate tax reductions and temporary individual tax cuts that are set to expire in 2025.

Some Republicans from high-tax states like New York have previously expressed concerns about certain aspects of Trump’s tax legislation, particularly the cap on state and local tax (SALT) deductions, which disproportionately affected taxpayers in states with higher local taxes.

Political analysts note that Lawler’s district, located in the New York City suburbs, contains many voters who may have been negatively impacted by these SALT deduction limitations.

Electoral Implications

As a Republican representing a swing district in a predominantly Democratic state, Lawler’s position may reflect political calculations ahead of future elections. New York Republicans in competitive districts often must balance party loyalty with local constituent concerns that may diverge from national party positions.

“Varney & Co.” is hosted by Stuart Varney and regularly features discussions on economic policy and political developments affecting financial markets. The program has become a popular venue for Republican lawmakers to discuss economic policy positions.

Lawler, first elected to Congress in 2022, has been working to establish his identity as a moderate Republican who is willing to break with party orthodoxy on certain issues. His appearance on the Fox Business program suggests he’s using tax policy as one area to demonstrate independence.

Broader Context of GOP Tax Discussions

The Republican Party continues to debate its economic platform following the Trump presidency. Some members advocate for extending or making permanent the 2017 tax cuts, while others have suggested modifications to address concerns from constituents in high-tax states.

Key points of contention within Republican tax policy discussions include:

- Whether to maintain the $10,000 cap on SALT deductions

- The appropriate level for corporate tax rates

- How to address the scheduled expiration of individual tax cuts

- Balancing tax cuts with concerns about the national debt

Lawler’s public stance against aspects of Trump’s tax policy adds another voice to this ongoing internal party debate. It remains unclear whether his position represents a growing trend among Republicans from similar districts or is more of an outlier based on his specific constituency.

The discussion on “Varney & Co.” underscores how tax policy continues to be a defining issue for Republicans as they craft their economic message ahead of future elections. With the 2017 tax cuts set to expire soon, Congress will need to address tax policy in the coming years, forcing lawmakers like Lawler to take clear positions on these issues.