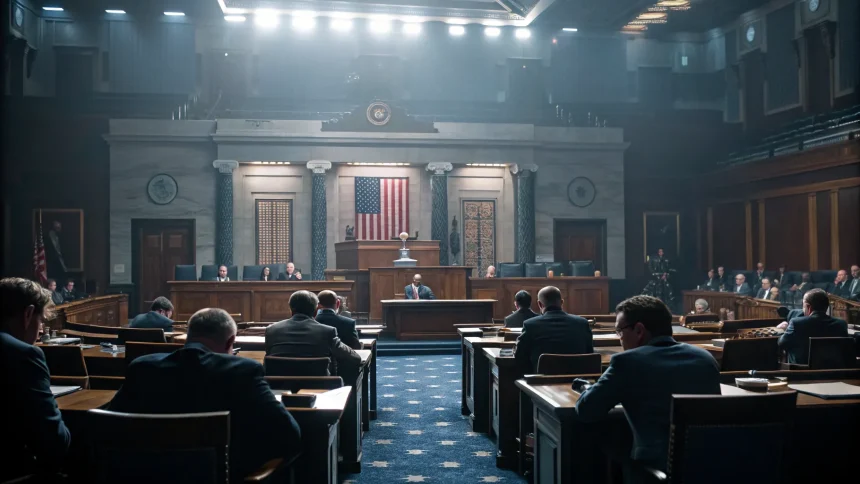

Congress is moving to raise a key federal credit cap, but the House and Senate disagree on how high to go. The dispute is unfolding inside the budget reconciliation process, a high-stakes route that lets tax and spending changes pass with a simple majority. The outcome could affect millions, from families planning for tax season to businesses weighing investment decisions.

Congress is trying to increase the maximum credit amount through its budget reconciliation process, but the chambers differ on proposed maximum amounts.

The timing is tight and the politics are tense. Leaders in both chambers say a higher cap would deliver relief, yet they are split over the scale and cost. The debate now turns on budget math, Senate rules, and competing priorities.

What’s at Stake

A higher cap would expand the value of a federal credit to eligible taxpayers. The precise size of the increase remains contested. Bigger caps generally mean larger refunds or lower tax bills for those who qualify. A smaller bump limits fiscal exposure but reduces the benefit.

The decision reaches far beyond accountants’ spreadsheets. Changes to a widely used credit can shift consumer spending, family budgets, and business planning. Lawmakers are weighing whether a larger near-term boost is worth higher projected deficits, or whether a tighter cap balances relief with cost control.

How Reconciliation Shapes the Debate

Reconciliation allows tax and spending bills to pass the Senate with a simple majority. It also limits floor debate and bars a filibuster. But it comes with restrictions.

- The Byrd Rule blocks “extraneous” items unrelated to budget changes.

- Provisions cannot add to deficits outside the budget window unless offset.

- Every line faces scrutiny from the Senate parliamentarian.

Those guardrails push lawmakers to tailor the credit cap to meet budget rules. That often means phasing changes in, setting end dates, or pairing increases with offsets. The Congressional Budget Office’s scoring will shape what survives.

Competing Priorities in Each Chamber

The House appears to favor a higher ceiling, framing it as immediate relief for households and a boost to demand. Supporters argue that a stronger cap can reach more people who have seen costs rise.

The Senate is signaling caution. Members point to deficit limits and procedural hurdles that could shrink or time-limit any increase. Some senators warn that a too-large expansion might be stripped under the Byrd Rule unless paired with revenue or cuts elsewhere.

Both chambers stress affordability, yet they differ on how to define it. The House leans into scale. The Senate leans into durability under the rules. The final number may hinge on offsets that satisfy deficit tests while preserving meaningful help.

What It Could Mean for Americans

For families, a higher cap could translate into larger refunds or lower tax liabilities. That can ease monthly bills and create a small cushion. For businesses, changes to credit caps can influence hiring, investment, or pricing, depending on eligibility and design.

The distribution matters. If the increase targets lower and middle incomes, consumer spending could tick up in necessities. If eligibility spans more taxpayers, the fiscal cost grows, but the benefit spreads further. Program design will determine winners and trade-offs.

The Data Questions Lawmakers Must Answer

Negotiators will look for clear answers on three fronts. First, how many taxpayers would benefit under each cap level. Second, the expected change to deficits over the budget window. Third, whether the change sunsets or becomes permanent. Without credible estimates, members risk advancing a plan that fails procedural tests or misses policy goals.

What to Watch Next

Committee markups will reveal the first concrete numbers. Expect tweaks to eligibility, indexing, or sunsets to meet Senate rules. If the chambers remain apart, a conference process will try to close the gap. The closer the cap is to the Senate’s comfort zone, the smoother the path to passage.

For now, one fact is clear: lawmakers want a higher cap, but the rules and the math will set the limit. The final bill will show whether Congress prioritizes a bigger short-term boost or a smaller, sturdier change that can pass the Senate’s gatekeepers. Watch the scoring, the sunset dates, and the offsets. That trio will tell the story before the vote does.