A new report released Thursday provides homebuyers with comprehensive information on average mortgage rates across various loan types, offering a valuable resource for those navigating the housing market. The report aims to help prospective homeowners make informed decisions by comparing different mortgage options available to them.

The document details current interest rates for common mortgage products, allowing consumers to evaluate which financing option might best suit their financial situation and homebuying goals. With housing affordability remaining a key concern for many Americans, access to clear rate information has become increasingly important for budget-conscious shoppers.

Comparing Loan Options

The report breaks down average rates for several mortgage types that prospective homebuyers commonly consider, including:

- 30-year fixed-rate mortgages

- 15-year fixed-rate mortgages

- Adjustable-rate mortgage (ARM) products

- FHA and VA loans

- Jumbo loans for higher-priced properties

By presenting this data in a single report, house hunters can quickly compare how different loan structures might affect their monthly payments and long-term costs. This side-by-side comparison helps clarify the trade-offs between lower monthly payments with longer terms versus higher payments with shorter terms and less interest paid over time.

Market Context and Rate Trends

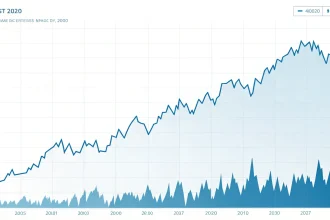

The timing of this report comes as mortgage rates have experienced significant fluctuations in recent months. Potential homebuyers have been closely monitoring these changes, as even small rate differences can translate to thousands of dollars over the life of a loan.

Financial analysts note that having access to current rate information is particularly valuable in today’s market environment. “Understanding the full spectrum of mortgage options and their associated rates is critical for anyone entering the housing market,” said one mortgage industry expert familiar with the report.

The data also provides context on how current rates compare to historical averages, giving shoppers perspective on whether today’s financing environment is favorable compared to past periods.

Making Informed Decisions

Beyond just listing rates, the report appears designed to help consumers match loan types to their specific needs. For instance, first-time homebuyers might benefit from learning about FHA loans with lower down payment requirements, while those planning to move within a few years might consider the initial savings of an adjustable-rate mortgage.

“Shopping for the right mortgage is just as important as shopping for the right house. The right financing can save you tens of thousands of dollars over time.”

Housing market observers point out that many buyers focus exclusively on the interest rate without considering other loan features that might better align with their financial goals. The report appears to address this by highlighting the unique characteristics of each loan type alongside their current rates.

Financial advisors recommend that prospective homebuyers use this information as a starting point for more personalized research, including consultations with mortgage professionals who can provide tailored advice based on individual credit profiles and financial circumstances.

As housing inventory levels remain tight in many markets across the country, being prepared with financing information gives buyers an advantage when they find a property that meets their needs. Understanding mortgage options in advance allows for quicker decision-making in competitive bidding situations.

The report serves as a reminder that while finding the right property is crucial, securing appropriate financing is equally important to successful homeownership. By comparing rates and understanding different mortgage structures, buyers can better position themselves for long-term financial stability in their new homes.