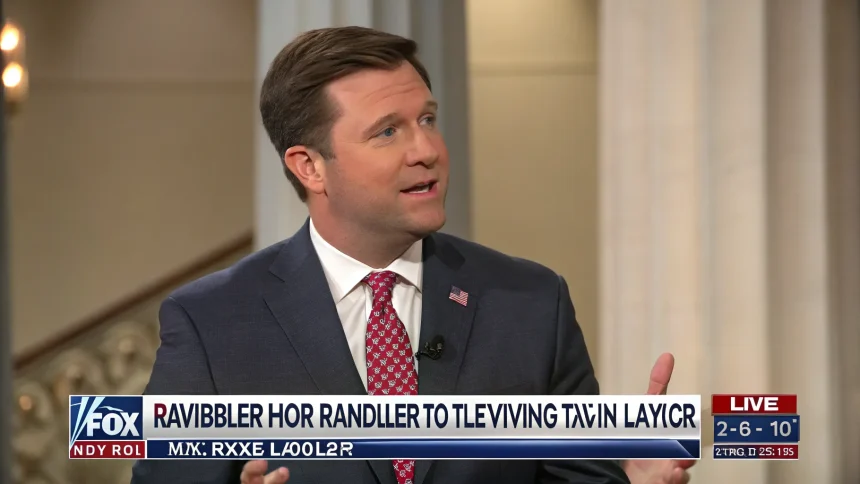

Republican Representative Mike Lawler of New York has voiced opposition to former President Donald Trump’s tax bill during an appearance on Fox Business Network’s “Varney & Co.” program. The congressman’s stance highlights growing divisions within the Republican Party over tax policy as the 2024 election cycle approaches.

Lawler, who represents New York’s 17th congressional district, shared his concerns about specific provisions in the tax legislation that was championed by Trump during his administration. The appearance marks a notable break from party unity on what has historically been a signature Republican policy achievement.

Republican Dissent on Tax Policy

During the Fox Business segment, Rep. Lawler articulated several points of contention with the Trump-era tax bill. His opposition comes at a time when Republicans are debating whether to extend key provisions of the 2017 Tax Cuts and Jobs Act, many of which are set to expire in 2025.

Lawler’s criticism appears to center on aspects of the legislation that disproportionately affect high-tax states like New York, particularly the cap on state and local tax (SALT) deductions that limited write-offs to $10,000.

“We need tax policy that works for all Americans across all states,” Lawler reportedly stated during the interview, though he maintained support for certain aspects of the broader Republican tax philosophy.

Regional Concerns Drive Opposition

As a representative from New York, Lawler’s position likely reflects the specific economic concerns of his constituents. The SALT deduction cap has been particularly unpopular in high-tax states like New York, New Jersey, and California, where many taxpayers saw their federal tax burdens increase despite the overall tax cut package.

Several Republican representatives from these states have broken with party leadership on this issue, forming a voting bloc that could prove crucial in any future tax legislation, especially given the narrow Republican majority in the House.

Political analysts note that Lawler’s district, which includes portions of Westchester and Rockland counties, contains many upper-middle-class and wealthy voters who were negatively impacted by the SALT deduction cap.

Implications for Republican Tax Policy

Lawler’s public opposition signals potential challenges for Republican leadership as they consider their approach to tax policy ahead of the 2024 elections. The party must balance the desires of its traditional fiscal conservative base with the regional concerns of members from high-tax states.

Tax policy experts point to three key areas of contention within the Republican caucus:

- The SALT deduction cap and its impact on high-tax states

- Corporate tax rates and their scheduled increases after 2025

- Individual income tax brackets that will revert to pre-2017 levels without congressional action

“This internal debate shows the complexity of crafting national tax policy in a diverse country with varying state tax structures,” said a tax policy expert familiar with congressional negotiations.

The disagreement also highlights the political calculations facing Republicans in competitive districts. Lawler, who flipped his district in 2022, must navigate between national party priorities and local constituent concerns.

As Congress approaches the expiration deadline for many provisions of the 2017 tax law, these internal Republican disagreements may play a significant role in shaping the party’s legislative agenda and campaign messaging for the upcoming election cycle.