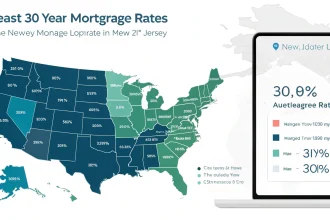

A new report released Friday provides homebuyers with detailed information on average mortgage rates, including adjustable-rate mortgages (ARMs), to assist consumers in selecting the most suitable home loan during their house hunting process.

The report comes at a time when prospective homeowners face a complex lending landscape, with various mortgage products offering different terms, interest rates, and payment structures. By comparing fixed-rate and adjustable-rate options, the report aims to give house shoppers the information needed to make informed financial decisions.

Understanding Mortgage Options

The Friday report breaks down current average rates for various mortgage products, allowing consumers to see how different loan types compare in today’s market. This information is particularly valuable for first-time homebuyers who may not be familiar with the range of financing options available.

Adjustable-rate mortgages, which typically offer lower initial interest rates compared to fixed-rate loans, receive special attention in the report. These loans feature interest rates that can change after an initial fixed period, making them attractive to certain buyers but potentially riskier for others.

Fixed-rate mortgages, by contrast, maintain the same interest rate throughout the life of the loan, providing payment stability but often at a higher initial rate than ARMs.

Factors Affecting Loan Selection

The report highlights several key considerations that should influence a homebuyer’s mortgage choice:

- Length of planned homeownership

- Financial stability and risk tolerance

- Current interest rate environment

- Personal financial goals

For buyers planning to stay in a home for a short period, the lower initial rates of ARMs might prove advantageous. However, those seeking long-term stability might benefit more from fixed-rate products, despite potentially higher initial costs.

Market Context

The timing of this report is significant as the housing market continues to experience fluctuations in both home prices and interest rates. Mortgage rates have seen considerable movement in recent months, making it critical for buyers to understand how different loan structures might perform under changing economic conditions.

“Comparing various mortgage options is essential in today’s market,” notes the report, emphasizing that even small differences in interest rates can translate to thousands of dollars over the life of a loan.

The analysis also examines how current economic indicators might influence future rate movements, giving buyers insight into potential risks and benefits of different mortgage products.

Housing experts suggest that this type of comparative information helps level the playing field for consumers who might otherwise feel overwhelmed by mortgage terminology and options.

The report serves as a practical tool for house shoppers who want to maximize their purchasing power while minimizing long-term costs. By understanding the full range of available mortgage products, buyers can align their financing with both their immediate housing needs and long-term financial plans.

As the housing market continues to evolve, having access to current, comprehensive mortgage rate information remains a valuable resource for anyone entering the homebuying process.