Yahoo Finance is sharpening its focus on individual investors, promoting a wide set of free features that aim to simplify money decisions. The platform says users can access stock quotes, news, portfolio tools, international market data, social features, and mortgage rates in one place. The message comes as retail investors seek reliable information and simple tools during choppy markets.

The company positions its offering as a one-stop hub for market tracking and personal finance. The pitch is straightforward: make it easier to manage investments and day-to-day money choices without extra fees. While rivals push paid tiers, Yahoo Finance is leaning on reach, habit, and a familiar brand to keep users engaged.

What Yahoo Finance Says It Offers

“At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.”

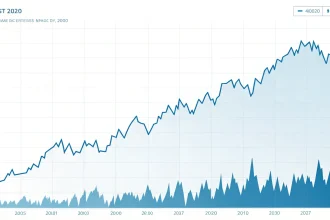

The promise centers on speed, breadth, and cost. Real-time or near real-time quotes help investors see price moves. News coverage keeps readers informed about earnings, policy shifts, and company moves. Portfolio tools let users track holdings, set alerts, and gauge performance.

- Market data: Quotes, charts, and watchlists for domestic and international markets.

- News and analysis: Company updates, interviews, and market summaries.

- Portfolio tracking: Holdings, alerts, and basic performance views.

- Personal finance: Mortgage rates and calculators for major money decisions.

- Community: Comment threads and tickers with user discussions.

Why This Matters for Retail Investors

Retail participation remains high by historical standards, even as trading volumes swing. Many investors still look for free tools instead of costly research products. That puts pressure on platforms to keep features accessible while improving quality.

Yahoo Finance has long served as an entry point for market data. For new investors, a clear layout and no-paywall access can reduce friction. For experienced users, breadth of tickers and archived information can aid quick checks during a trading day.

Mortgage rate listings expand the service past investing into personal finance. It links market moves to borrowing costs, which can influence budgets, homebuying, and refinancing decisions.

Competition and User Concerns

Competition is intense. Brokerages now bundle research, screening tools, and learning hubs. News sites host live blogs and newsletters. Social platforms spread market chatter in real time. Yahoo Finance stands out on breadth and price, but it competes for attention every trading day.

Users often weigh three factors: reliability, speed, and signal quality. Free platforms can face questions about data freshness and the depth of analysis. Community features add value when conversations are informed. They can also add noise if moderation lags.

Privacy and data use remain top of mind. Any ad-supported service must communicate how data is handled and how settings can be adjusted. Clear policies and controls can build trust among returning users.

Trends Shaping the Next Phase

Three trends are steering investor tools. First, more investors want cross-asset coverage from stocks to ETFs, treasuries, and crypto. Second, mobile usage and alerts drive engagement. Third, simple dashboards are winning over complex screens that confuse new users.

Platforms that balance depth with clarity may gain loyalty. Educational explainers and context around headlines can reduce mistakes during volatile sessions. Linking macro news to personal finance decisions may also help users act with more confidence.

What to Watch

Watch for upgrades to screening tools, faster charting, and tighter integration between news, alerts, and portfolio pages. Expect more regional data to support global investors. Stronger community moderation and verified voices could lift the quality of discussion.

Investors will also watch how mortgage rate information evolves. Side-by-side comparisons, historical charts, and calculators can turn a quick check into a practical plan for a major purchase.

Yahoo Finance’s push to keep key tools free is timely. It meets the demand for accessible information without adding paywalls. The next test is execution: data freshness, context that reduces confusion, and clearer ties between market news and personal decisions. For readers, the takeaway is simple. Use the free tools, verify sources, and let a steady plan guide trading and borrowing choices. The market will keep shifting, but well-organized information can help keep emotions in check.