Seven months after a suspected $140 million investment scheme fell apart, the people who put in their savings are still waiting for answers and cash. Hearings, claims, and legal filings have dragged on while account balances remain frozen. The clock is ticking for families and retirees who say they need relief now.

The collapse left hundreds, and possibly thousands, of account holders in limbo. Some wired funds days before the failure. Others funneled retirement accounts into promised “low-risk” strategies. Most now face the same question: how much, if any, will come back.

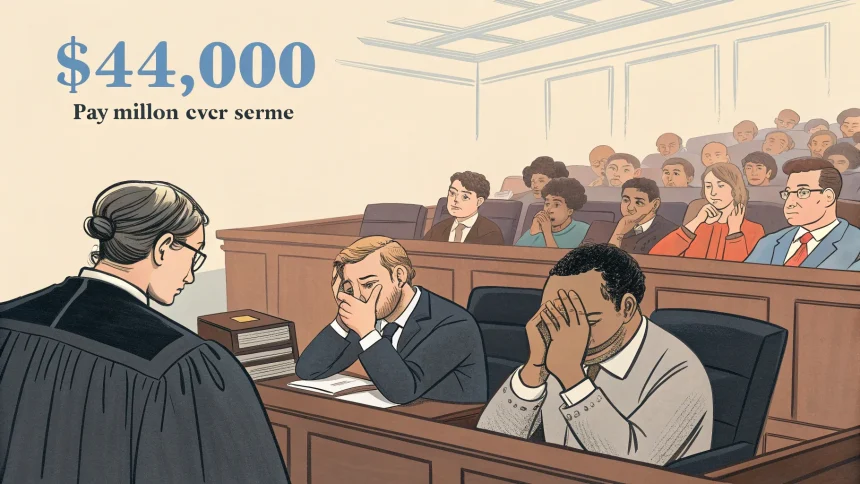

“Seven months after an alleged $140 million Ponzi scheme collapsed, investors are impatient to recover their money.”

What We Know So Far

Authorities have not yet announced a final tally of victims or a precise recovery plan. A court-appointed receiver or bankruptcy trustee typically takes control of remaining assets, reviews records, and starts a claims process. That process often takes months or years, not weeks.

Legal filings in similar cases show how slow the work can be. Teams must trace money across dozens of bank accounts, seize property, and unwind transfers to insiders. Every step faces court review. Every objection adds delay.

The Long Road to Recovery

Victims often ask why payouts do not start sooner. Lawyers explain that paying early can create unfair results if later claims change the math. The law leans on equal treatment based on documented losses, not on who shouts the loudest.

Recoveries in past fraud cases have ranged widely. Some victims get most of their principal back; others receive only a fraction. Outcomes depend on how much cash remains, what can be clawed back, and the cost of running the case.

- Asset tracing: banking records, crypto wallets, and wire histories.

- Clawbacks: lawsuits to retrieve transfers to insiders or early investors.

- Claims review: verifying losses and rejecting inflated or duplicate claims.

- Interim distributions: partial payments if enough cash is secured.

Inside the Legal Playbook

Receivers and trustees use tools designed for fraud cleanups. That includes freezing orders, subpoenas, and clawback claims against “net winners” who withdrew more than they put in. Those suits are often unpopular but can add meaningful dollars to the recovery pool.

Experts caution that litigation costs matter. Aggressive lawsuits may bring in money but also drain the estate through fees. Judges balance the chance of recovery against time and expense, pushing for deals when possible.

Insurance can help, but policies often exclude fraud. Banks and service providers might face claims if they missed obvious red flags, yet those cases are hard to win and can stretch for years.

Investor Frustration Builds

For many victims, the wait is personal. Rent is due. College bills hit. Retirees who counted on steady payments now face budget gaps.

At recent status updates, investors pressed officials to set a date for first distributions. Some asked for hardship advances. Others demanded a public accounting of seized assets and legal spend so far.

One victim described selling a car and taking a second job to cover losses. Another said the worst part is not the money but “the silence and the guessing.”

Red Flags and Lessons

Fraud experts point to familiar warning signs: returns that barely vary, pressure to reinvest, vague descriptions of a “proprietary” strategy, and unlicensed promoters. They advise checking registrations, reading audited financials, and using independent custodians.

Simple steps can help:

- Verify licenses and disciplinary history on official databases.

- Demand third-party account statements, not screenshots.

- Be skeptical of “guaranteed” returns or secret models.

- Diversify; never concentrate retirement funds in one product.

What Comes Next

In the months ahead, the court will likely hear updates on asset sales, settlements, and clawback filings. A schedule for claims approval could set the stage for an initial, partial payout. Transparency will be key to rebuilding trust.

For now, investors want two things: a clear timeline and proof that every dollar is being chased. Their patience is thin. Their need is real. The next hearing—and the first distribution plan—will show whether the case is moving from paperwork to paychecks.