Bullseye Option chief market analyst Alan Knuckman offered a clear read on stocks during a segment of The Claman Countdown, outlining where momentum may build and where caution remains. His on-air review sized up the next moves for investors as trading desks sort through earnings signals, rate expectations, and energy price swings.

The appearance centered on the state of the market and what indicators matter most right now. Knuckman spoke to risk appetite, sector strength, and how options pricing can flag turning points. The discussion aimed to help viewers weigh opportunity against volatility and to place short-term moves in a broader frame.

Key Drivers Shaping Sentiment

Market direction often turns on three threads. The first is the path of interest rates and how quickly borrowing costs may ease. The second is corporate profit guidance, especially from large-cap leaders. The third is movement in commodities, which can influence inflation expectations and margins.

Knuckman’s focus aligns with those themes. He pointed to the link between yields and equity multiples, and how rate relief can support higher valuations. He also emphasized how earnings surprises can reset price targets, especially in sectors with strong cash flow.

- Rates: Lower yields tend to lift growth stocks and rate‑sensitive sectors.

- Earnings: Guidance changes can shift sector leadership within days.

- Commodities: Energy price swings ripple through costs and consumer spending.

Reading Options For Early Signals

As an options veteran, Knuckman often looks to pricing and flows for clues on direction. Implied volatility can rise before big catalysts. Shifts in the put‑call balance can reveal hedging or speculative interest.

He highlighted how options can frame risk in choppy markets. Defined‑risk trades help traders stay engaged while capping downside. Time decay and strike selection remain central to managing exposure through data releases and earnings days.

Options activity also can signal rotation. Heavy call buying in cyclicals may foreshadow a shift from defensive names. Elevated put interest in high flyers can hint at profit taking rather than a change in the long trend.

Sectors In Focus

Investors continue to scan for durable growth and improving margins. Technology and communication services often lead when rates fall. Industrials and financials can gain when the economy shows steady demand and credit conditions improve. Energy tends to track supply news and global demand updates.

Knuckman’s comments suggested a balanced approach. He pointed to the value of pairing leaders with laggards that show improving technicals. He also noted that dividend payers can cushion portfolios during pullbacks, while select growth names may still set the pace when liquidity improves.

What Volatility Means For The Next Move

Volatility is not only a risk measure; it is a pricing tool. When volatility rises, options premiums expand, rewarding sellers who can tolerate swings. When it falls, buyers may find cheaper exposure to potential catalysts.

Knuckman emphasized patience and levels. Support and resistance zones matter when news flow is heavy. Breakouts on strong volume carry more weight than thin moves. Fading extremes can work, but only with strict risk controls.

Strategies Viewers Heard

While every portfolio is different, the segment highlighted a few practical ideas that fit choppy conditions.

- Defined‑risk options trades to frame upside while limiting losses.

- Staggered entries to avoid mistiming a single buy or sell.

- Sector mix that blends growth leaders with value names showing fresh momentum.

- Event awareness around earnings, jobs data, and inflation updates.

The Broader Context

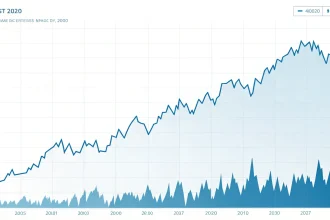

For months, markets have toggled between hopes for easier policy and worries about sticky inflation. Corporate America has adapted with cost controls and selective hiring. Productivity gains have helped preserve margins even as input costs move around.

Historically, stocks have managed through similar periods. Rate cycles end, and earnings trends reassert themselves. In the meantime, positioning and discipline matter most. Options markets provide a timely view of where traders see risk and potential upside.

Knuckman’s appearance left viewers with a clear message. Focus on rates, earnings, and energy. Use options to manage risk and stay engaged. Watch sector rotation for early tells on the next leg. For investors, the near term may hinge on upcoming data and guidance. The longer view still leans on profits and cash flow. Keep plans simple, define risk, and let price action confirm the story.